Contents:

It means that the company’s management has decided to retain $3m in the company for its future growth and investments. It is shown as the part of owner’s equity in the liability side of the balance sheet of the company. Additional Paid-In CapitalAdditional paid-in capital or capital surplus is the company’s excess amount received over and above the par value of shares from the investors during an IPO.

Balance SheetA balance sheet is one of the financial statements of a company that presents the shareholders’ equity, liabilities, and assets of the company at a specific point in time. It is based on the accounting equation that states that the sum of the total liabilities and the owner’s capital equals the total assets of the company. The Balance SheetA balance sheet is one of the financial statements of a company that presents the shareholders’ equity, liabilities, and assets of the company at a specific point in time.

What is shareholders’ equity?

Tom begins a https://1investing.in/ and puts in $1,000 from his personal checking account and a laptop computer valued at $1,000. This $2,000 amount is a capital contribution since Tom has contributed capital in the form of cash and property to the business. SCORE has a sample business balance sheet in a spreadsheet format that you can use to put together a balance sheet for your business. And this article takes you step-by-step through the process of preparing a balance sheet for a business startup. Only sole proprietor businesses use the term “owner’s equity,” because there is only one owner. Generally, when looking at equity you want to consider the value of something and how much you owe is on that value.

Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. Lastly, if the firm’s financial leverage increases, the firm can deploy the debt capital to magnify returns. DuPont analysis is covered in detail in CFI’s Financial Analysis Fundamentals Course. If the net profit margin increases over time, then the firm is managing its operating and financial expenses well and the ROE should also increase over time.

There is in depth information on the formula of this financial indicator below the tool. On the balance sheet of a sole proprietorship, the owner’s equity is recorded on the line for the owner’s or partner’s capital account. If the business is a corporation, owner’s equity goes under the heading of shareholder’s equity or stockholder’s equity on the balance sheet. Treasury shares or stock (not to be confused with U.S. Treasury bills) represent stock that the company has bought back from existing shareholders. Companies may do a repurchase when management cannot deploy all of the available equity capital in ways that might deliver the best returns. Shares bought back by companies become treasury shares, and the dollar value is noted in an account called treasury stock, a contra account to the accounts of investor capital and retained earnings.

What is owner’s equity?

Under the model of a private limited company, the firm may keep contributed capital as long as it remains in business. If it liquidates, whether through a decision of the owners or through a bankruptcy process, the owners have a residual claim on the firm’s eventual equity. If the equity is negative then the unpaid creditors take a loss and the owners’ claim is void. Under limited liability, owners are not required to pay the firm’s debts themselves so long as the firm’s books are in order and it has not involved the owners in fraud. In finance, equity is an ownership interest in property that may be offset by debts or other liabilities.

Berkshire Hathaway: Analyzing Owners’ Equity – Investopedia

Berkshire Hathaway: Analyzing Owners’ Equity.

Posted: Thu, 28 Jul 2022 07:00:00 GMT [source]

Private equity generally refers to such an evaluation of companies that are not publicly traded. The accounting equation still applies where stated equity on the balance sheet is what is left over when subtracting liabilities from assets, arriving at an estimate of book value. Privately held companies can then seek investors by selling off shares directly in private placements.

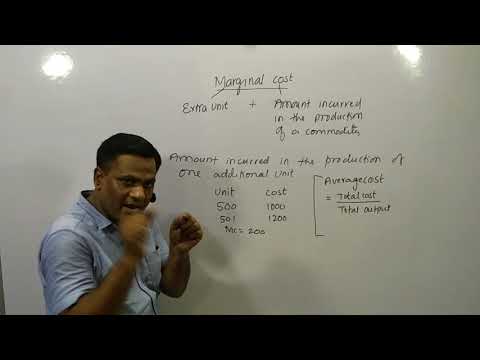

Video Explanation of Return on Equity

But it also tells how much of the business you, or the owners, own. While the simple return on equity formula is net income divided by shareholder’s equity, we can break it down further into additional drivers. As you can see in the diagram below, the return on equity formula is also a function of a firm’s return on assets and the amount of financial leverage it has. The closing balances on the statement of owner’s equity should match the equity accounts shown on the company’s balance sheet for that accounting period. Owner’s equity is the share of a company’s net assets that the owner — or owners — can claim as their own.

- It is the profit a company gets when it issues the stock for the first time in the open market.

- Subtract $150,000 from $500,000 to compute the owner’s equity of $350,000.

- It works the same way, but it’s about the value of your interest in a business you own or have a stake in.

- Thanks to this fact, it is more useful when we want to analyze a company with long-term debt.

Midsize Businesses The tools and resources you need to manage your mid-sized business. Your Guide to Growing a Business The tools and resources you need to take your business to the next level. Your Guide to Running a Business The tools and resources you need to run your business successfully. Your Guide to Starting a Business The tools and resources you need to get your new business idea off the ground. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Equity can be found on a company’s balance sheet and is one of the most common pieces of data employed by analysts to assess a company’s financial health. Refers to the amount over and above the stated par value of the stock that the shareholders have paid to acquire the company shares. Corporations are formed when a business has multiple equity ownership, but unlike partnerships, corporation owners are provided legal liability protection.

If a business owner takes money out of their owner’s equity, the withdrawal is considered acapital gain, and the owner must pay capital gains tax on the amount taken out. Owner’s equity is an owner’s ownership in the business, that is, the value of the business assets owned by the business owner. It’s the amount the owner has invested in the business minus any money the owner has taken out of the company. Another financial statement, the statement of changes in equity, details the changes in these equity accounts from one accounting period to the next.

Owner’s equity refers to the portion of a business that is the property of the business’ shareholders or owners. The simple explanation of owner’s equity is that it is the amount of money a business would have left if it shut down its operations, sold all of its assets, and paid off its debts. A sustainable and increasing ROE over time can mean a company is good at generating shareholder value because it knows how to reinvest its earnings wisely, so as to increase productivity and profits.

Return on equity vs. return on capital employed

Outstanding shares refers to the amount of stock that had been sold to investors but have not been repurchased by the company. The number of outstanding shares is taken into account when assessing the value of shareholder’s equity. The withdrawals are considered capital gains, and the owner must pay capital gains tax depending on the amount withdrawn.

To illustrate the calculation, a simplified balance sheet for the fictional RCL Manufacturing Co. is shown below. A real balance sheet would typically include more detailed breakdowns of assets and liabilities. A negative owner’s equity often shows that a company has more liabilities than assets and can signify trouble for a business. Of the sole proprietorship’s balance sheet and is a component of the accounting equation. Stockholders’ equity is the remaining amount of assets available to shareholders after paying liabilities. Locate the company’s total assets on the balance sheet for the period.

Sue is right on the middle of Florida’s busy season, the winter. She has snowbirds from all across the northern states flying in to buy her seashells. Since it is January, she prepares a balance sheet listing her assets, liabilities, and owner’s equity as of December 31 of the previous year. Norman wants to know his equity in the business, so he gets his balance sheet for the previous year.

This metric is a key component of a amortization definition‘s financial statement analysis as it provides important information about the company’s financial position. It represents the cumulative total of all the profits that a company has earned but has chosen to keep rather than distribute to shareholders. A company with consistently high levels of retained earnings may be better positioned to weather economic downturns.

Subtract $150,000 from $500,000 to compute the owner’s equity of $350,000. If you run or invest in a business, you need to know how to calculate owner’s equity. This measure of a firm’s value is reported each quarter and annually on the balance sheet, which is one of the standard financial statements firms must prepare. One way to think of it is that book value or owner’s equity is the amount that would remain if the business were liquidated and all debts were paid off. Also, the company had a loan amounting to $30,000 from the bank, creditors worth of $10,000 representing credit purchases made during the financial year.

Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. The higher the ROE of a company, the firmer and more beneficial its situation on the market. Note that debt doesn’t “pass on.” There is either liability on the part of the owners or there is not.

Owner’s equity or shareholder’s equity is an important concept for all business owners and investors to understand, as it can show the actual intrinsic value and financial health of a business. Knowing the basics of how to read a balance sheet and calculate owner’s equity is an important skill for owners of businesses of all sizes, as well as for investors of public companies. Unlike public corporations, private companies do not need to report financials nor disclose financial statements. Nevertheless, the owners and private shareholders in such a company can still compute the firm’s equity position using the same formula and method as with a public one. Current liabilities are debts typically due for repayment within one year (e.g. accounts payable and taxes payable).

If the asset turnover increases, the firm is utilizing its assets efficiently, generating more sales per dollar of assets owned. Furthermore, it is useful to compare a firm’s ROE to its cost of equity. A firm that has earned a return on equity higher than its cost of equity has added value. The stock of a firm with a 20% ROE will generally cost twice as much as one with a 10% ROE . Finally, the ratio includes some variations on its composition, and there may be some disagreements between analysts.