Content

General economic conditions could be impacting customer cash flows, requiring them to delay payments to their suppliers. This issue is a major one, since the problem arises entirely outside of the business, giving management no control over it. This gives them https://online-accounting.net/ 37.96, meaning it takes them, on average, almost 38 days to collect accounts. The importance of metrics for your accounts receivable and collections management isn’t lost on you. You need a measuring stick to determine exactly how effective your efforts are.

Multi-omics microsampling for the profiling of lifestyle-associated … – Nature.com

Multi-omics microsampling for the profiling of lifestyle-associated ….

Posted: Thu, 19 Jan 2023 08:00:00 GMT [source]

If a company consistently has high ACP, there is a problem with its accounts receivable and collection process. By automating them with HighRadius Autonomous Receivables, businesses can significantly improve their order to cash cycle. A company’s average collection period gives an insight into its AR health, credit terms, and cash flow.

Average Collection Period Formula

Automating the order to cash process to make it more efficient will also help reduce DSO. This is because failing to collect credit sales or convert credit sales into cash on time Average Collection Period: Overview and Formula will have a negative impact on the company in at least two ways. For example, consider a business that had $25,000 of average account receivables over the course of a single year.

What will the information I provide be used for?

Wage information and other confidential unemployment compensation information may be requested and utilized for other governmental purposes, including, but not limited to, verification of an individual’s eligibility for other government programs. 20 C.F.R. § 603.11(b).

The average collection period figure is also important from a timing perspective to help a company prepare an effective plan for covering costs and scheduling potential expenditures to further growth. Definition of Accounts Receivable Collection Period An accounts receivable collection period, also known …

A Strategic Financial Tool

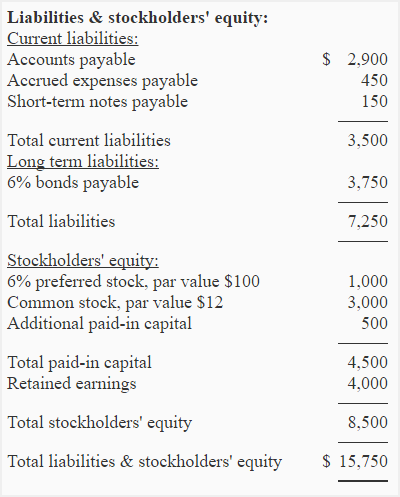

In order to calculate the average collection period, the company’s accounts receivable (A/R) carrying values from its balance sheet are needed along with its revenue in the corresponding period. It can set stricter credit terms limiting the number of days an invoice is allowed to be outstanding. This may also include limiting the number of clients it offers credit to in an effort to increase cash sales.

It is one of the many vital accounting metrics for any company that relies on receivables to maintain a healthy cash flow. A high average collection period suggests that a company is taking too long to collect payments.

What Is the Average Collection Period Formula?

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. It’s easy to think that the only thing that matters about invoices is that they get paid, but actually, the time required for each invoice to be fulfilled is also crucial. About the AuthorErik Larson Erik Larson frequently writes about small business, entrepreneurship, startups, finance, marketing and operations. When he’s not writing, he enjoys hiking, frisbee golfing, reading, and being a father. You will learn how to use its formula to assess a company’s operating efficiency. If the company decides to do the Collection period calculation for the whole year for seasonal revenue, it wouldn’t be just. Second, knowing the collection period beforehand helps a company decide the means to collect the money due to the market.

For this reason, the efficiency of any business collection process is a crucial element to its success. To avoid this, companies should analyze their clients first, before extending credit lines to them. If a client has a history of late payments with other suppliers, the company should not provide goods or services through credit, as the collection of such sales will probably be difficult. Additionally, administrative systems should provide the Billing Team with reminders of due invoices, to prompt them to follow up in order to reduce the ratio.

Working with mailed payments, such as post office box partnerships, lockbox banking, pre-authorized checks, and pre-authorized debits. An appropriate performance measure would be to have no more than 15 to 20% of total AR in more than 90 days. Integrating best practices into the collections department and team can help to improve collection efficiency. Tammy teaches business courses at the post-secondary and secondary level and has a master’s of business administration in finance. On the other hand, if your results are better than average, you know you’re operating efficiently, and cash flow might be a competitive advantage. In the same year, your company also logged $200,000 in total net sales.

How do I file a claim for unemployment insurance benefits?

The fastest and most efficient way to file a new claim is to file online – click here . If you don’t have access to a computer, you may file over the phone by calling 1-888-737-0259.

The average collection period is a measurement of the average number of days that it takes a business to collect payments from sales that were made on credit. Businesses of many kinds allow customers to take possession of merchandise right away and then pay later, typically within 30 days.